|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDUSTRY PROFILE

Commercial Printing - Sample

|

|

2732, 2752, 2754, 2759

|

| 3231 |

|

|

|

| XX/XX/200X |

|

|

|

|

|

Industry Overview |

|

|

The commercial printing industry in the US includes around 35,000 companies with $90 billion of annual revenue. Several giants like RR Donnelley and Canadian printer Quebecor World have multibillion revenues, but most printers considered "large" have annual revenues under $1 billion. The majority of commercial printers are small or midsized businesses that operate one production plant, employ fewer than 20 people, and have annual revenue under $5 million. Despite continuing consolidation, the industry is highly fragmented; the largest 50 companies hold only about 30 percent of the market.

|

COMPETITIVE LANDSCAPE |

|

Demand depends largely on the advertising and product needs of business customers. The profitability of individual companies is closely linked to effective sales operations. Large companies have scale advantages in purchasing materials like paper and ink, in serving large customers who have regional or national needs, and in making efficient use of expensive presses. But small companies can compete effectively by offering better local service. Annual revenue per employee averages $145,000.

|

|

Digital technology is changing the competitive landscape of the commercial printing market. Prices for digital color pages are falling below offset printing prices and companies who fall behind in the shift to digital printing are at risk.

|

PRODUCTS, OPERATIONS & TECHNOLOGY |

|

Commercial printers produce magazines, phone books, labels, advertising brochures, catalogs, newspaper inserts, direct mail marketing pieces, corporate reports and other financial printing, training manuals, promotional materials, and business forms. (Book publishers and newspaper publishers are not included in this industry.) Most commercial printers offer four distinct services: design and other prepress services; actual printing; finishing (including folding, cutting, and binding); and fulfillment, which includes packing, storing, and shipping (often on a "just-in-time" basis). Other services can include packaging, database management, Web design, CD services, training, and consulting.

|

|

A typical commercial printer has different presses and binding equipment available to work on various types of jobs. The main printing process used is offset lithography, using either individual sheets (sheet fed presses) or continuous rolls of paper (web presses). Sheet fed presses print up to 16 pages of letter-sized product (a 16 page "signature") at a time, at speeds up to 15,000 impressions per hour. Web presses print 32 pages at a time at speeds over 40,000 impressions per hour, and are usually used for production runs of more than 50,000 copies.

|

|

Presses usually print in one, two, four, or six colors; some presses can print eight. Digital presses are still used primarily in specialty applications. Paper is the biggest individual manufacturing cost, often amounting to 25 percent of revenues. Printing papers are often coated, and are bought in sheets or rolls from distributors. Some customers provide their own paper, but most is bought for customers, with a modest price markup. Paper prices can vary significantly from year to year. Commercial printers generally don't keep large inventories of paper as requirements change from job to job. Instead, they rely on regional distributors to provide the many varieties and grades. Inks, films, printing plates, and cleaning solvents are other major material costs. The solvents used to clean inks off the presses can be a major air quality problem.

|

|

Major press manufacturers include Heidelberg and Komori for conventional presses; and Xerox, Hewlett-Packard’s Indigo, Kodak's Nexpress, and Punch Graphix’s Xeikon for digital presses. Large ink manufacturers include Sun Chemical and Flint Group.

|

|

Printing technology is evolving rapidly. Virtually all prepress work is now done with computers. Digital presses are still expensive and used mainly for special types of work, but the movement to an all-digital printing environment is occurring rapidly. Small printers may be unable to make the investments in digital technology.

|

SALES & MARKETING |

|

The largest single market for printing services is advertising, for newspaper inserts, magazines, and direct mail materials. Although some work may be done regularly for large customers under long-term contracts (magazines, product catalogs, and phone books), most is on a project basis, often after a bidding process. Work may be episodic and many printers keep extra presses to meet anticipated peak demands. Marketing is usually done by a traditional sales force calling on potential customers.

|

|

Commercial printing is a local business. Small printers can compete effectively with large ones because the small size and high variability of most printing jobs means that few economies are achieved by having larger presses. The high degree of personal attention that most print jobs require, such as client approvals of proofs and "press checks" during actual printing, means that customers prefer to use a local printer. Price is often a secondary consideration to quality and timeliness. Some types of printing, such as magazines and catalogs with large print runs, are more effectively handled by large printers.

|

FINANCE & REGULATION |

|

Commercial printers generally keep low material inventories and don't require inventory financing. Receivables are generally collected within 60 days, and are sometimes financed. Equipment is often financed, or is leased. Presses have become more expensive, though more versatile, because of computerized controls and enhancements.

|

|

Some printers have difficulty maintaining adequate workplace air quality standards, and emit pollutants into the air, mainly because of solvents in ink and the solvents used to clean ink from printing plates. Some printers also generate toxic wastes because of inks and solvents. Workplace safety may also be a problem, although the illness and injury rate has decreased rapidly in the past decade. Workplace regulations are enforced by OSHA and state agencies.

|

REGIONAL & INTERNATIONAL ISSUES |

|

Large amounts of the paper used by commercial printers are imported from Canada. Total paper imports to the US are close to $10 billion per year, of which $7 billion are from Canada.

|

|

Commercial printing is primarily a local business and imports and exports are less than 10 percent of US sales. China and Canada account for over half of all imports, while Canada, the United Kingdom, and Mexico are the largest export markets.

|

HUMAN RESOURCES |

|

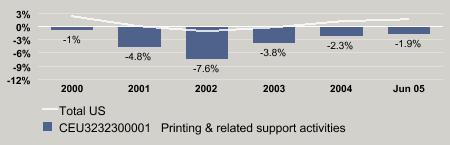

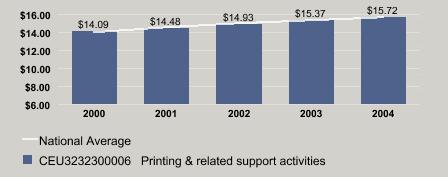

Production personnel in commercial printing plants include employees with special skills in operating complicated machines, and lower-paid, relatively unskilled workers. Average hourly wages are near the national average of $16. Fringe benefits are an additional 19 percent of wages. Although some printing jobs are directly concerned with presses, an increasing number are in prepress design and layout that make greater use of computer skills.

|

|

The number of people employed in commercial printing has been declining in the last five years, as more of the work has become automated. The industry’s annual injury rate is comparable to the national average for all industries.

|

Industry Employment Growth

Bureau of Labor Statistics |

|

|

|

Average Hourly Earnings & Annual Wage Increase

Bureau of Labor Statistics |

|

|

|

|

|

INDUSTRY INDICATORS |

|

US corporate profits, an indicator for corporate demand for printing services, fell 7 percent in the second quarter of 2008 compared to the same period a year ago.

|

|

The spot price of crude oil, a key cost factor in commercial printing operations, skyrocketed 65 percent in the week ending August 22, 2008, compared to the same week a year ago.

|

MONTHLY NEWS*

(Available to subscribers only) |

|

|

| North America's Largest Enterprise IT Event and the Pre-Eminent Digital Printing Event Bring Nearly 30,000 Visitors and 425 Exhibitors to the Boston ... | |

| Business Wire, 28 March, 2007, 1078 words | |

| NEWTON, Mass. - (BUSINESS WIRE) - With 425 exhibitors and close to 30,000 attendees, North America's largest enterprise IT event and the pre-eminent digital printing event - AIIM and ON DEMAND Conferences & Expos - will arrive in Boston on ... | | | | Quad/Graphics to Become Exclusive Printer for L.L.Bean Catalogs | |

| PR Newswire (U.S.), 26 March, 2007, 664 words | |

| SUSSEX, Wis., March 26 /PRNewswire/ -- Under terms of a newly signed multi-year, multi-million-dollar agreement, Quad/Graphics will become the exclusive printer and prepress provider for L.L.Bean catalogs beginning in January 2008. ... | | | | High-Profile Printers in the Industry Limelight | |

| Printing News, 12 March, 2007, 454 words | |

| The printing industry is one of the largest industries in the United States, with total annual sales estimated to be in excess of $165 billion. The largest segment of the industry is commercial printing, which generates more than $50 ... | | |

|

QUARTERLY INDUSTRY UPDATE |

|

More Specialization, Less Consolidation Set to Affect Printers -

The commercial printing industry is greatly affected by the state of the paper industry, and Printing News magazine recently outlined its predictions for the paper market in 2007. The analysis did not specifically predict price increases, but pointed to a growing trend in the paper industry towards specialization, in response to the consolidation of recent years that has resulted in higher paper prices. In 2006, paper prices were approximately 5 percent higher than 2005, according to the Center for Paper Business and Industry Studies.

|

|

Postal Rate Increases Coming in May -

The price of postage is set to increase again in May, along with some additional rule changes, all of which could affect the commercial printing industry. The price increase is varied based on the type of piece to be mailed, and the new rules also take into account the shape of marketing pieces, rather than the old system that relied on weight as the primary measure of cost. Industry experts are predicting several potential outcomes for printers, including a drive toward efficiency and the potential for a reduction in clients’ willingness to do mass mailings because of the increased costs.

|

|

Oil and Natural Gas Prices Starting to Affect Printers -

Industry experts have recently noted that the oil and natural gas price increases of the past few years may soon begin to impact printers’ materials. Printers have already been dealing with paper price increases, and may soon find that it is necessary to pass on the costs of other raw materials to customers. Most of the products used in the printing process, including inks and resins, are derived from either oil or natural gas.

|

* (Available to subscribers only) |

|

|

Business Challenges |

CRITICAL ISSUES |

|

Dependence on Business Activity -

The volume of commercial printing is closely tied to the health of the US economy. While advertising is the mainstay of commercial printing, financial printing has also grown rapidly in the past decade. Both advertising and financial activity are sharply affected by the economy and stock market.

|

|

Fluctuating Paper, Ink Costs -

Printers feel the impact of cost fluctuations of paper and ink prices, as paper accounts for about 25 percent of printing costs. Paper price increases don't directly affect profits for many printers because they pass paper costs to customers, but lower prices encourage more volume. Environmental issues in paper manufacture may raise paper prices. Ink prices are affected by fluctuations in oil and resin prices.

|

OTHER BUSINESS CHALLENGES |

|

Reduced Use of Printed Material -

Information distribution via electronic means, such as the Internet and especially email, will reduce demand for printed materials. Company annual reports and prospectuses are now available electronically over the Internet, electronic catalogs are supplanting print catalogs for orders placed over the Internet or via telephone, and electronic versions of documents that can be stored and viewed on portable devices may eventually supplant many printed magazines.

|

|

Competition from In-House Printing -

Laser and color printers in corporations and small businesses now produce many jobs formerly handled by commercial printers. Even smaller companies can produce many documents on their own high-volume printers. According to the Association for Suppliers of Printing and Publishing Technologies, the use of desktop color printers will grow by 10 percent annually. Copy shops have further taken business from traditional printers.

|

|

Transitioning to Digital Technology -

As their cost per page continues to decline, digital presses will supplant offset presses for more and more print jobs. Commercial printers who delay in investing in digital presses will find themselves at a competitive disadvantage. The high initial cost of digital presses may be difficult for small printers to afford. Printers will also incur additional costs for hiring and training workers to operate these new presses and new software systems for prepress and postpress services.

|

|

Competing on Speed -

Customers are demanding faster and shorter runs, forcing printers to find ways to increase speed while maintaining profit margins. As cycle times shorten, incremental improvements may not by themselves shave enough time to meet ever-increasing customer demands for speed. By 2010, 30 percent of all printing will be turned around in one day or less, according to Printing Industries of America (PIA).

|

|

|

Trends & Opportunities |

BUSINESS TRENDS |

|

Lower Cost Per Page -

Advances in both digital and conventional offset printing technology are lowering the cost per page for new printers. InfoTrends projects that the decline in cost per page will average 10 percent per year through 2010. As the cost of color printing has dropped, spot color is starting to replace previously all black and white print jobs.

|

|

Digital Image Storage -

Because of the increasing conversion of images to digital format before printing, some commercial printers now provide digital inventory services. Some printers, in an effort to expand services, are capitalizing on their new expertise in the transfer, manipulation, and storage of digital images, especially in the front-end Computer-Aided Design (CAD) process, Web page design, CD production, and generally in document and information management and distribution.

|

|

Mass Customization -

Commercial printing is moving toward imaging for "an audience of one." Use of variable data and selective binding capabilities is key to mass customization of printed products. Market research firm InfoTrends projects variable data revenue growth to continue at an annual rate of 37 percent through 2010. Already, three of the largest printing companies, RR Donnelley, Quad/Graphics, and Fry Communications, are benefiting from selective binderies.

|

|

New Printing Technologies -

With the introduction of digital plate-making, the entire printing process can now be handled most effectively using digital technology. The traditional printing process relies on cameras and photographic film as an intermediate step in the photochemical production of the plates used in printing. New processes can make film from digital images without using a camera.

|

INDUSTRY OPPORTUNITIES |

|

Technology Broadening Geographic Market Areas -

Increased use of digital files and low-cost courier services, and the increased ability of modern presses to accurately reproduce digitally prescribed colors, allow printers to solicit and fulfill orders from distant customers using the Internet. Online print production management solutions can save money on reworks, late fees, and obsolete materials. Online print shops like FedEx Kinko's, Mimeo, and NowDocs specialize in printing and binding electronically prepared materials that can be delivered overnight. Commercial printers able to invest in this technology will supplant many traditional operations.

|

|

Value-Added Services -

Front-end design services and back-end inventory and distribution services are often as valuable as press operations. Electronic prepress, finishing, binding, packaging, database management, Web page design, CD services, training, and consulting are services that provide extra value for customers.

|

|

Online Print Production -

Innovative commercial printers are using the Web to allow clients to track jobs. FedEx Kinko's, Mimeo, and NowDocs have online print shops that enable customers to submit and monitor jobs online, print at the vendor’s site, and receive overnight delivery. New online services have transformed the printing industry, eliminating the costly and time-consuming prepress stage.

|

|

Security Document Printing -

Printers are busy developing innovative new products to meet tighter security demands for printed documents. Numerous types of inks, including UV and fluorescent, infrared (IR), thermochromic, photochromic, and magnetic, can be used. Some industry experts believe that IR ink printing will be a growth area.

|

|

New Inks, Equipment Technology -

New ink and equipment technology can improve commercial printing operations and reduce long-term costs. Interest in single-fluid inks has increased. Single-fluid inks, which are waterless and water-washable, provide faster startups and wider temperature latitude, with no solvents required for cleanup. And a new, low-cost computer-to-plate (CTP) system targeting small commercial printers might save up to 50 percent in material costs by eliminating waste.

|

|

|

Executive Insight

* (Available to subscribers only) |

CHIEF EXECUTIVE OFFICER - CEO |

Developing Diverse Customer Base

Demand for printing services is cyclical because it depends on economic activity. During the 2001 recession, US printing activity declined 15 percent. In local markets, swings in demand by customers in specific industries can be even greater. Companies can prepare for changes in demand by owning equipment that can switch to other types of printing, courting different types of customers, and offering alternative services. | | |

Expanding Digital Expertise

Rapid advances in digital technology present printers with opportunities to provide new and faster services using digital presses and composition software. Digital presses are more expensive but more versatile, and are useful for the short production runs typical for most projects. Digital technology is especially useful for providing prepress services, such as design and composition, and for communication with customers. | | |

|

CHIEF FINANCIAL OFFICER - CFO |

Reducing Equipment Costs

To minimize equipment costs, printers may use a combination of ownership and leasing, and may buy used rather than new equipment. Because of specialized printing requirements, printers often lease presses and binding equipment that are used only occasionally. The switch to digital presses has expanded the availability of high-quality used printing equipment. | | |

Reducing Receivables Risk

Some printers may get a large proportion of their business from a few large customers and therefore have a large concentration of receivables. Companies in the industry often have receivables of 60 days or more. To reduce receivables impact on cash flow, printers may finance the receivables of large customers. | | |

|

CHIEF INFORMATION OFFICER - CIO |

Evaluating Digital Presses

Despite higher costs, digital presses from manufacturers like HP, Indigo, and Xerox provide greater flexibility than standard off-set presses. Because they use toners or liquid ink applied directly to paper – rather than a printing plate – digital presses are suitable for short print runs or for print jobs that must be done rapidly. Per unit costs are high, quality and printing speed aren’t as good, and prices for digital presses are higher than for off-set presses. | | |

Increasing Prepress Capabilities

Many printers have expanded into higher-margin design and composition work, acquiring computerized design systems and hiring graphic designers. Prepress work may include page composition, typesetting, image manipulation, graphic design, proofing, and editing. The output from such digital systems can go directly to digital presses, traditional off-set plate systems, or to electronic media, and allow customers to easily view proofs before printing. | | |

|

HUMAN RESOURCES - HR |

Hiring and Training Design Specialists

Digital and graphic design systems require workers with different skills than those needed for traditional printing. Graphic designers are typically paid 50 percent more than regular printing workers. The high cost of such workers means that only printers with a steady volume of work can afford to provide high-quality prepress design services. | | |

Improving Workplace Safety

The nature of printing work exposes employees to special types of workplace risks. Although the safety record for printers, on average, is better than for all private industry, commercial printers have twice the rate of repetitive motion injury and three times the rate of injury from hands caught in machinery. The use of solvents to remove ink can create toxic effects if cleaning and ventilation aren’t done properly. | | |

|

VP SALES/MARKETING - SALES |

Improving Customer Relationships

Many printers receive a large amount of their business from repeat customers, but don’t have a retention strategy. Because of the large number of printers who can provide equivalent services, customer turnover can be high. Computerized customer relationship management (CRM) systems like can help printers efficiently maintain regular contact with customers. | | |

Implementing Web-Based Marketing and Customer Service

As Internet search ads have become a common alternative to traditional Yellow Pages’ advertising, some printers have built sophisticated websites to advertise services and give price quotes. Some printers allow customers to track the progress of their print orders online, view order history, and re-order. | | |

|

|

|

|

Call Preparation Questions |

CONVERSATION STARTERS |

How does the company respond to fluctuating demand for services?

The volume of commercial printing is closely tied to the health of the US economy.

|

How does the company mitigate increases in ink and paper costs?

Printers feel the impact of cost fluctuations of paper and ink prices, as paper accounts for about 25 percent of printing costs.

|

How does increased use of digital media affect the company's production volume and sales?

Information distribution via electronic means, such as the Internet and especially email, will reduce demand for printed materials.

|

What plans does the company have to add new computer or digital technology to improve production and services?

Increased use of digital files and low-cost courier services, and the increased ability of modern presses to accurately reproduce digitally prescribed colors, allow printers to solicit and fulfill orders from distant customers using the Internet.

|

What non-printing value-added services does the company offer, and to what benefit?

Front-end design services and back-end inventory and distribution services are often as valuable as press operations.

|

How have online print production management solutions impacted the company's cost savings and processing speed?

Innovative commercial printers are using the Web to allow clients to track jobs.

|

QUARTERLY INDUSTRY UPDATE |

How will new postal rate increases affect the company?

The new rate structure could lead to fewer direct mailings for many direct marketers.

|

Other than transportation, how do rising natural gas and oil prices lead to higher raw material costs?

Most of the materials used in the commercial printing industry are derived from oil or natural gas.

|

OPERATIONS, PRODUCTS, AND FACILITIES |

In what types of work does the company specialize?

Some examples include magazines, phone books, labels, checks, coupons, advertising brochures and catalogs, newspaper inserts, direct mail marketing pieces, corporate reports and other financial printing, training manuals, and business forms.

|

What types of presses does the company have?

A company may have sheet fed, Web presses, two-, four-, six-, or eight-color or digital presses. Larger, heavier-duty 40-inch presses open the door to packaging print jobs.

|

Does the company use digital or film processing methods?

Most larger advertising agencies and publishers have gone to total digital processes.

|

Does the company use computer-to-plate technology?

Computer-to-plate units can lower costs and reduce waste compared to traditional image setting machines.

|

How much prepress design work does the company do?

Electronic prepress is the fastest-growing segment of the industry.

|

Does the company buy paper from one or several sources?

Most printers order paper for each printing job from wholesale distributors.

|

How does the company's print capacity utilization vary from month to month?

Due to the high fixed costs for presses, capacity utilization is key to profitability.

|

What finishing and fulfillment services does the company offer?

Finishing services include folding, cutting, and binding. Fulfillment includes packing, storing, and shipping. Some companies offer selective binding to customize documents for individual customers.

|

CUSTOMERS, MARKETING, PRICING, COMPETITION |

What is the average size of a customer order?

|

How many customers does the company serve? In what types of industries?

Advertising and financial printing are the largest markets for commercial printing.

|

Does the company specialize in a particular industry?

Small printers may specialize to offer better customer service and specialized capabilities.

|

Who are the company's competitors?

Companies typically compete with other local printers, but the Internet is allowing companies to offer their services on a wider geographic basis.

|

Does the company have any long-term contracts?

Contracts are unusual except for long-run printing of magazines, catalogs, and directories, because they require special investment in large presses. Most commercial printing work is on a project basis, often after submission of bids to the customer.

|

How sensitive are customers to price?

Some customers are more concerned about quality and timeliness than price.

|

REGULATIONS, R&D, IMPORTS AND EXPORTS |

Has the company experimented with new types of ink?

Interest has increased in single-fluid inks, which are waterless, and water-washable inks that provide faster startups and wider temperature latitude; their cleanup requires no solvents.

|

Does the company have any export business?

This is unusual except for specialized products like banknotes.

|

How has the company addressed ergonomics and safety in its business?

Commercial printers have high rates of repetitive motion injury and injury from hands caught in machinery.

|

ORGANIZATION AND MANAGEMENT |

How does the printer plan to mitigate higher medical insurance costs for employees?

The largest increase in expenses is estimated to come from employee medical benefits.

|

Is the company a division of a larger corporation?

Some local companies are operated semi-autonomously by consolidators.

|

What challenges has the company faced in recruiting skilled personnel, especially for prepress services?

Because of the competitive demand for people with computer skills, printers have had difficulty finding enough skilled personnel.

|

How big a sales force does the company have?

Marketing is usually through a traditional sales force calling on potential customers. Technology has enabled many firms to branch out geographically.

|

FINANCIAL ANALYSIS |

Are revenue and cash flow seasonal?

Printers with a lot of customers in advertising have their greatest work load in third and fourth quarters.

|

When does the company project it will need new presses? How does the company typically finance new presses?

Presses are the largest single investment of a printer, often accounting for 40 percent of total assets.

|

Does the company routinely pass the cost of paper to customers?

Most printers put a small markup on paper. Some customers provide their own paper.

|

BUSINESS AND TECHNOLOGY STRATEGIES |

What computer or digital technology does the company use in equipment or processes?

Digital prepress design, digital presses, Internet communications, and digital image inventory are some.

|

Does the company plan to add non-printing value-added services?

Front-end design services and back-end inventory and distribution services are becoming more valuable to customers. Packaging, electronic prepress, finishing, binding, database management, Website design, CD services, training, and consulting are some of the services that printers offer.

|

What role does the Internet play in the company's current and future operations?

Some printers use Internet sites to receive digital files from customers; others use them for marketing.

|

What are the company's most important opportunities for growth?

The overall outlook for printers is for low growth, so companies are looking for opportunities to expand services and markets.

|

How does the company differentiate itself from competitors?

Price, quality, fast service, and special services are some ways to compete.

|

|

|

Financial Information |

COMPANY BENCHMARK INFORMATION |

PRINTING AND RELATED SUPPORT ACTIVITIES

(NAICS: 3231) |

|

|

ECONOMIC STATISTICS AND INFORMATION |

| Index of Industrial Production - Federal Reserve Board |

| |

2002 |

2003 |

2004 |

2005 |

2006 |

Feb 07 |

| G323 Printing & related support activities |

-5.9% |

-3.7% |

0.7% |

1.9% |

4.4% |

4.0% |

All Manufacturing |

0.0% |

1.1% |

2.5% |

3.2% |

4.0% |

3.4% |

|

VALUATION MULTIPLES |

| Commercial Printing |

| Acquisition multiples below are calculated using at least 107 private, middle-market (valued at less than $1 billion) industry transactions completed between 1/1993 and 12/2006. Last update: February 2007. |

| Valuation Multiple |

Equity/Net Sales |

Equity/Net Income |

MVIC/Net Sales |

MVIC/EBIT |

| Median Value |

0.6 |

7.4 |

0.6 |

7 |

|

Equity (Equity price) = Reported selling price

MVIC (Market Value of Invested Capital) = Equity price + Long-term liabilities assumed

EBIT (Earnings Before Interest & Taxes) = Net Income + Interest expense + Taxes

|

| SOURCE: Pratt's Stats™ (Portland, OR: Business Valuation Resources, LLC) To purchase more detailed information, please either visit www.BVMarketData.com sm or call Business Valuation Resources at 888-287-8258. |

|

|

|

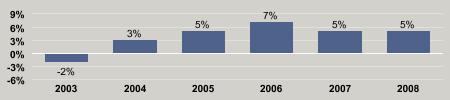

Industry Forecast |

|

The output of US commercial printing is forecast to grow at an annual compounded rate of 7.1 percent between 2006 and 2009.

|

| Commercial Printing Growth Fairly Steady |

|

|

First Research forecasts are based on INFORUM forecasts that are licensed from the Interindustry Economic Research Fund, Inc. (IERF) in College Park, MD. INFORUM's "interindustry-macro" approach to modeling the economy captures the links between industries and the aggregate economy.

Forecast FAQs

|

| |

First Research Opportunity Rating

|

| The First Research Opportunity Rating is First Research’s estimate of industry performance vs. industry risk over the next 12 to 24 months. |

|

|  | Demand increases with advertising demand |  |

|  | New technology improves efficiency |  |

|  | But digital communications reduce long-term demand |  |

|

|

|

Weblinks & Acronyms |

INDUSTRY WEBSITES |

|

Graphic Arts Monthly

Business magazine for the printing industry. |

WhatTheyThink.com

“Competitive intelligence for printing executives.” |

|

The Association for Suppliers of Printing, Publishing, and Converting Technologies

Conferences, trade shows, education, government affairs, international trade, market data, market research, product safety, standards, publications, and legal issues. |

National Association of Printing Ink Manufacturers

Convention and general information; publications; issues concerning health, safety, and the environment; two magazines. |

National Association for Printing Leadership (NAPL)

Newsletters, publications, discussion forums, events, an online marketplace, and advice on sales, marketing, human relations, operations, technology, and financial management. |

Society for Service Professionals in Printing (SSPP)

Links, events, training, a newsletter, and product information for customer service representatives and managers who work in the printing industry. |

Specialty Graphic Imaging Association (SGIA)

Industry news and weekly updates on the advances and interests of digital and specialty imaging and printing. |

Ink World Magazine

Articles on printing ink and coating industry. |

Print Solutions Magazine

Top distributors, news, links, stock watches, archives, and FAQs for form printing entrepreneurs written by the Document Manufacturers Industries Association. |

| |

GLOSSARY OF ACRONYMS |

| CAD - Computer-Aided Design |

| CTP - Computer-To-Plate |

| EDI - Electronic Document Interchange |

| EDSF - Electronic Document Systems Foundation |

| NPES - The Association for Suppliers of Printing, Publishing, and Converting Technologies |

| PIA - Printing Industries of America, Inc. |

|

|

|

|

|

|

|

|

|

|